I met David at the recent conference in Sweden. His research explains the financial underpinnings of the Great Reset.

Oct 21, 2023

Have you ever attended a lecture on finance that started at 11pm, went till 1am and the room was still packed? This was a first time for me, and I attended a lot of conferences in my life. The lecture was by David Webb. His topic – The Great Taking, by which he means the mechanism of immediate confiscation of your financial assets by the owners of the central banks. This mechanism is already in place (it is not dependent on the digital IDs and CBDC). If you thought you owned the financial securities in your retirement account, think again – turns out they are not really yours. I had a good conversation with David over dinner. Ivor Cummins was at the same event and recorded this interview with David:

As a side note, Ivor recorded an interview with me as well, and I hope he will post it soon (or maybe it’s not suitable for YouTube as I don’t self-censor? we shall see!)

Due Diligence and Art is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

David’s book “The Great Taking” can be downloaded for free here.

What is this book about? It is about the taking of collateral (all of it), the end game of the current globally synchronous debt accumulation super cycle. This scheme is being executed by long-planned, intelligent design, the audacity and scope of which is difficult for the mind to encompass. Included are all financial assets and bank deposits, all stocks and bonds; and hence, all underlying property of all public corporations, including all inventories, plant and equipment; land, mineral deposits, inventions and intellectual property. Privately owned personal and real property financed with any amount of debt will likewise be taken, as will the assets of privately owned businesses which have been financed with debt. If even partially successful, this will be the greatest conquest and subjugation in world history. Private, closely held control of ALL central banks, and hence of all money creation, has allowed a very few people to control all political parties and governments; the intelligence agencies and their myriad front organizations; the armed forces and the police; the major corporations and, of course, the media. These very few people are the prime movers. Their plans are executed over decades. Their control is opaque. To be clear, it is these very few people, who are hidden from you, who are behind this scheme to confiscate all assets, who are waging a hybrid war against humanity. The Author has deep experience with investigation and analysis within challenging and deceptive environments, including the mergers and acquisitions boom of the 80’s, venture investing, and the public financial markets. He managed hedge funds through the period spanning the extremes of the dot-com bubble and bust, producing a gross return of more than 320% while the S&P 500 and the NASDAQ indices had losses. His clients included some of the largest international institutional investors.

It is now assured that in the implosion of “The Everything Bubble”, collateral will be swept up on a vast scale. The plumbing to do this is in place. Legal certainty has been established that the collateral can be taken immediately and without judicial review, by entities described in court documents as “the protected class.” Even sophisticated professional investors, who were assured that their securities are “segregated”, will not be protected.

An enormous amount of sophisticated planning and implementation was sustained over decades with the purpose of subverting property rights in just this way. It began in the United States by amending the Uniform Commercial Code (UCC) in all 50 states. While this required many years of effort, it could be done quietly, without an act of Congress.

These are the key facts:

- Ownership of securities as property has been replaced with a new legal concept of a “security entitlement”, which is a contractual claim assuring a very weak position if the account provider becomes insolvent.

- All securities are held in un-segregated pooled form. Securities used as collateral, and those restricted from such use, are held in the same pool.

- All account holders, including those who have prohibited use of their securities as collateral, must, by law, receive only a pro-rata share of residual assets.

- “Re-vindication,” i.e. the taking back of one’s own securities in the event of insolvency, is absolutely prohibited.

- Account providers may legally borrow pooled securities to collateralize proprietary trading and financing.

- “Safe Harbor” assures secured creditors priority claim to pooled securities ahead of account holders.

- The absolute priority claim of secured creditors to pooled client securities has been upheld by the courts. Account providers are legally empowered to “borrow” pooled securities, without restriction. This is called “self help.” As we will see, the objective is to utilize all securities as collateral.

The “self help” applies to “market participants”, meaning definitely not you, the person whose retirement savings are invested in those markets. “Market participants” is a euphemism for the powerful creditors who control governments via debt. The establish their legal certainty with respect to the financial assets while removing yours. Interestingly, besides a small group of the private mafia behind the veneer of the central banks, nobody else is really protected. Not even the multi-millionaires and billionaires if they hold financial securities in the same collateralized structure.

In the next global financial panic, what are the chances that there will be much of anything remaining in these pools of securities after the secured creditors have helped themselves?

There will be a game of musical chairs. When the music stops, you will not have a seat. It is designed to work that way. It is time to ask: cui bono? Who benefits?

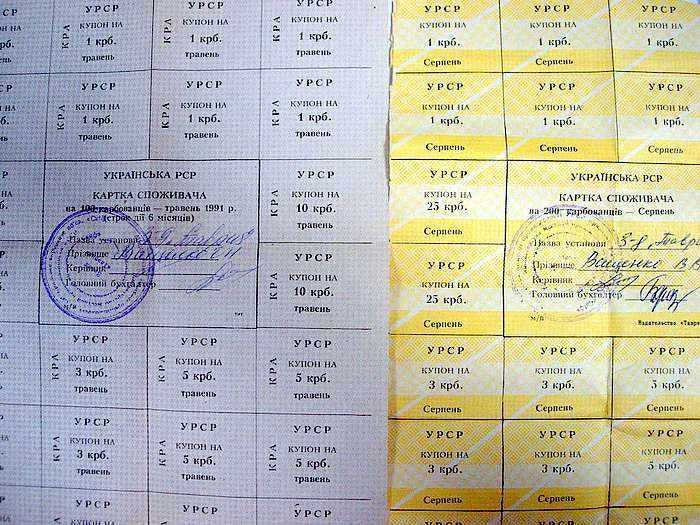

From my personal experience, I already lived through one “great taking”, performed by whoever collapsed the Soviet Union. When Ukraine became independent from the former USSR in 1991, the ruble and any savings that anyone had at Sberbank (the only bank that existed in the USSR) disappeared overnight, and were not replaced. One can argue this was a very simple exercise given that only one state-owned bank was involved or needed to implement this reset, and there were no financial instruments, only cash savings in that bank. My grandparents had meager savings there and ended up with zero. I had no money at all as a young person, and I guess that can be a plus – when you own nothing, nobody can confiscate it from you. Afterwards, there was no currency in circulation in the country for approximately 2 years until hryvna was designed and printed and introduced. During those years, people (including me) received paychecks in the form of this – gov issued IOUs exchangeable for goods in stores that had any goods.

According to David Webb, the real assets that are owned without debt are probably the most secure, and my personal experience corroborates this. Privately owned businesses that also have no debt are probably fairly secure too, but in the event of a large scale market collapse they may or may not be able to continue as a going concern. In addition, as we saw in Lahaina and elsewhere, the global puppeteers have more tricks to steal land and other assets whether financed with debt or not.

Whether the Great Taking will occur or not, and when, is hard to predict. The scale is also hard to predict – all at once, regional, or some “market participants” but not others – all remains a possibility. In the meantime, all we can do is understand the system that is set up and being used against us, understand the agenda and the goals of the evil empire. This will enable effective individual decisions and actions we make every day.

You can support this publication by a one-time donation on Ko-fi:

I am running really low on art, so here is another photo from Iceland:

Due Diligence and Art is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.”

Leave a Reply